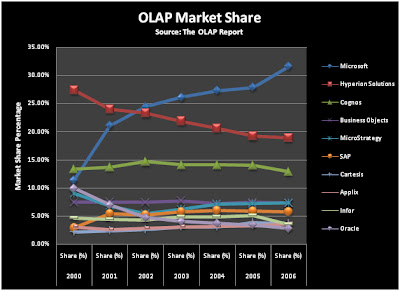

This graph illustrates the OLAP Product Market Trends from 2000 to 2006, as published in 2007; however, the data does not account for the market consolidations which occurred in 2007, the effects of which are discussed in the first section above.

Business Intelligence OLAP Vendors are ranked and not their individual products, it should be noted that many of the vendors supply multiple OLAP products and applications. Calculating OLAP market shares is quite an involved process, and these figures include OLAP server and client software, applications and OLAP consulting, whether performed by the software author or third-parties. The resulting estimates for the top ten OLAP vendors are shown above.

As the Oracle acquisition of Hyperion did not occur until 2007, it did not change the 2006 or earlier figures, but from 2007, Hyperion’s share will be merged with Oracle’s (which was previously rather low). The joint share will show a declining trend, as both companies separately had declining OLAP market shares, though in absolute terms, it will push Oracle into a stronger second rank behind Microsoft, from its previous weak tenth position.

Business Intelligence OLAP Vendors are ranked and not their individual products, it should be noted that many of the vendors supply multiple OLAP products and applications. Calculating OLAP market shares is quite an involved process, and these figures include OLAP server and client software, applications and OLAP consulting, whether performed by the software author or third-parties. The resulting estimates for the top ten OLAP vendors are shown above.

As the Oracle acquisition of Hyperion did not occur until 2007, it did not change the 2006 or earlier figures, but from 2007, Hyperion’s share will be merged with Oracle’s (which was previously rather low). The joint share will show a declining trend, as both companies separately had declining OLAP market shares, though in absolute terms, it will push Oracle into a stronger second rank behind Microsoft, from its previous weak tenth position.

It took many years for Microsoft SQL Server to establish credibility in the enterprise relational database management system (RDBMS) market; conversely, it has taken much less time for Microsoft SQL Server Analysis Services to achieve the leading position in the OLAP market place. The OLAP Report, announced in 2002 that Microsoft SQL Server 2000 Analysis Services the market leader and has continued to increase that market share year on year.

Examining the graph above you can see that, Microsoft claimed 31.6 percent of the OLAP market in 2006, with Hyperion grabbing 18.9 percent of the market, and Cognos coming in at 12.9 percent. The rest of the vendors held less than a 10 percent market share respectively. The second and third vendors accounted for 31.8 percent of the market, showing that Microsoft has almost double the market of its nearest competitors.

Microsoft is the only major database vendor to have a significant portion of the OLAP market. Oracle had 2.8 percent of the market which lead them to acquire Hyperion in 2007 to improve their overall standings, and IBM only captured 2.2 percent of the market. Both Oracle and IBM have been continually losing market share, however Microsoft gained in the markets overall installations.

Long term, Business Intelligence will play a major role in the competitive position of the major database vendors. The ultimate purpose of Business Intelligence—whether you're using OLAP, data mining, or an old-fashioned spreadsheet—is to help users and companies make better decisions. So, it stands to reason that almost all companies should be using data analytics (or BI) in some capacity.